How Scammers Target Co-operative Bank Customers

Co-operative banks have become increasingly vulnerable to scams in recent years. Scammers often target customers through phone calls, emails, and other methods of communication, trying to get them to divulge confidential information such as bank account numbers or passwords. They may also use phishing techniques, using fake websites or links that look legitimate but are actually malicious. Once they have the customer's personal details, they can then access their accounts and take out money without their knowledge.

During the first half of 2022, a staggering £60 million was stolen through impersonation scams targeting banks according to UK Finance. Fraudsters also successfully stole an additional £31 million by pretending to be other organisations such as utility companies, communications providers and government departments.

A few words about Co-operative bank

The Co-operative Bank is a British financial services company that was founded in 1872. It began as a small group of local cooperatives which aimed to provide mutual support and access to affordable banking services for their members. Over the years, the bank has grown significantly and now serves over 4 million customers across the UK with a range of banking products and services. The Co-operative Bank puts its customers at the center of everything it does, aiming to create an environment where people can secure their financial future responsibly and ethically. It also works with other partners to help promote social justice, environmental sustainability and economic development in its communities. Through this commitment, it strives to make a positive difference in society.

Watch out for the latest scams!

A few days ago, a report of further scams and impersonation of the Co-operative Bank was tweeted.

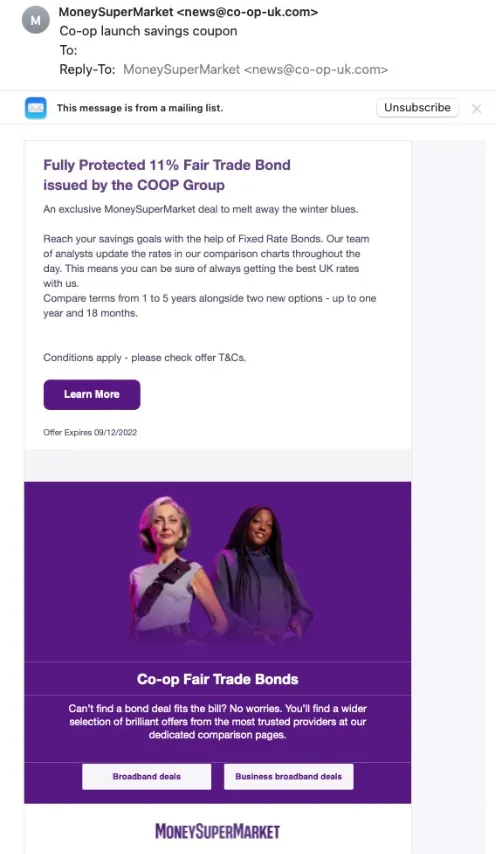

One tweet said: "Criminals cloning @MoneySupermkt & @CooperativeBank are sending out emails flogging fake 'Fully Protected 11% Fair Trade Bond issued by the COOP Group'".

The emails sent by both Co-operative Bank and Money Supermarket look very professional. They are in the company colours, have the logo and all the necessary information. At first glance it is hard to see that something is wrong. What should cause you uncertainty?

Always start by checking the email address from which the message was sent. In this case it is www.co-op-uk.com. The bank's official website is https://www.co-operativebank.co.uk/.

As you can see, the false website refers to the name of the genuine company and if someone is not tempted to check that everything is correct, they could be fooled further.

Remember that if you receive e-mails from any institution, the only form of verification is your vigilance. Only by casting doubt on them and then checking them will you protect yourself from being scammed.

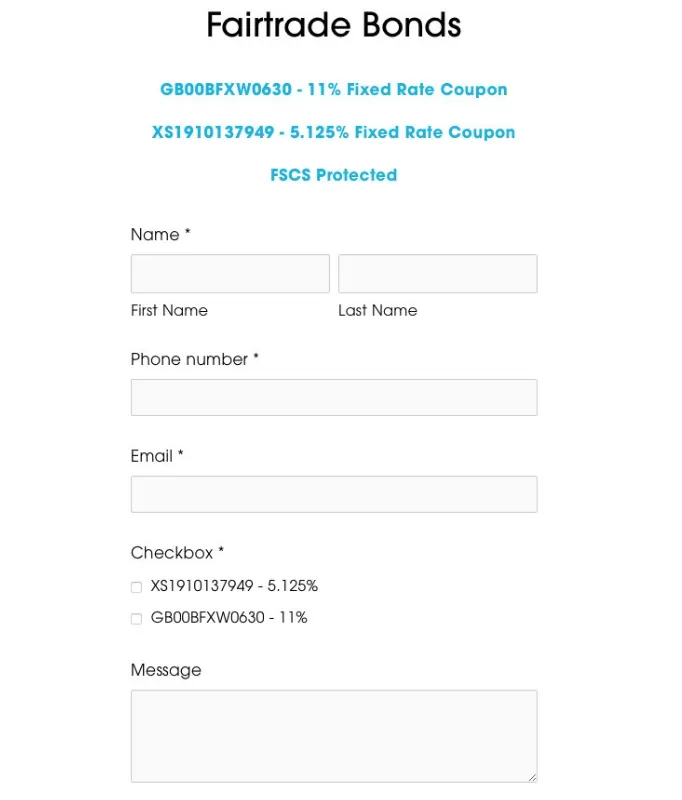

After clicking on the link, you are redirected to a form where you will be asked to enter your contact details or to make a payment. The scammers want to trick you into giving all the information they need so that they can then use it, for example by selling your details to other companies or making purchases from them.

Therefore, never give out your personal or financial details, payment details or online banking details on the Internet, especially if it is someone from the outside who contacts you and asks for them. Never pay any upfront fee.

What else can you expect from Co-operative bank scammers?

Virtually every bank is impersonated by fraudsters. Co-operative is one of them. Recently, the bank's social media accounts featured an official announcement from the bank stating that:

"🚨 Fraud alert: Criminals are calling people claiming to be from The Co-operative Bank's Fraud Department.

Be vigilant:

✋ We'll never tell you that you need to move your money or offer to open a new account for you to keep it safe".

Impersonation of bank employees or government officials is a huge problem these days. These professions involve a great deal of trust from the public and, as a result, people who are unaware that someone might be impersonating them have their attention lulled.

Another warning states that their customers had recently been a target of scammers who were posing as bank staff and sharing the full card number with them while on the call. Criminals seek to steal your trust by asking for sensitive information such as 'Memorable Name'. Steer clear of these fraudsters and protect yourself from becoming a victim! Stay alert, stay vigilant.

If you are a victim of bank crime call 159 - this number will quickly redirect you to your bank, so you can report scams and suspected fraudulent activity.

How to protect yourself from such a scam?

One of the most effective protections against banking scams is to take proactive steps to protect your personal and financial information. Start by securing all online accounts with strong passwords that are unique, hard-to-guess, and not used for any other accounts. Make sure to regularly change your passwords and never store them in an easily accessible place. Additionally, make sure you are using a secure connection (encrypted) whenever accessing your bank account or performing transactions online.

It’s also important to be aware of phishing emails from unknown sources – emails which often appear as if they have been sent from legitimate organizations asking for confidential information such as credit card numbers or bank details. Never provide this type of sensitive information via email or text message. Instead, contact your bank directly to verify the request.

Finally, make sure you are monitoring your account activity closely and regularly. Check your credit card bills carefully and report any suspicious activity immediately to your financial institution. This will help ensure that any potential fraud is detected early before it can cause significant damage. By taking these proactive steps, you can protect yourself from many common banking scams and reduce the risk of becoming a victim of fraud or identity theft.

By following the advice outlined above, you can make sure that your personal and financial information stays safe and secure. Taking these steps not only helps protect you from banking scams but also provides peace of mind. Knowing that you’re taking the right precautions will help ensure a secure financial future.

Summary

Customers should be aware of the various signs of a scam and protect themselves by not revealing any sensitive information over the phone or online unless they can verify the caller's identity. It is also important to be cautious when clicking on emails or links from unknown sources. Additionally, customers should keep their password and PINs secure and never share them with anyone.

Banks have implemented a number of security measures to help protect customers from fraud and theft, including identity verification systems, encryption technology, multi-factor authentication, and strong passwords. However, it is still important for customers to take extra precautions when dealing with co-operative banks in order to avoid becoming victims of scams. Customers should always do their research before transacting with any bank or financial institution and only conduct business through secure channels. Additionally, they should monitor their accounts regularly in order to detect any suspicious activity. By following these steps, customers can better protect themselves against co-operative bank scams.