How to Spot a Get-Rich-Quick Scheme: The Fraudsters' Playbook

In these tough times, it can be easy to be tempted by a "get rich quick" scheme. After all, who wouldn't want to make money easily and without any effort? Unfortunately, these schemes are nothing but scams. Fraudsters use various tactics to try and lure people in, such as using phrases common in the banking world or involving solicitors. However, there are some tell-tale signs that can help you spot a scam from a mile away. In this blog post, we will discuss the fraudster's playbook and how you can avoid being scammed.

Don't be fooled by people claiming they are effortlessly making money online course

So, how can you spot a get-rich-quick scheme? One of the most common signs is an offer of returns that are far greater than those offered by legitimate investments. For example, if someone offers you the opportunity to double your money fast, it's likely too good to be true. Other red flags include the use of meaningless phrases or statements, as well as the involvement of solicitors who may be unaware that their names are being used in a scam.

How to spot a get rich quick scheme?

When it comes to investing your hard-earned money, it's important to be careful and avoid get-rich-quick schemes for a quick profit. These schemes usually involve promising high returns and more money online within a short space of time, with little or no risk. They may also ask you to download software or make a phone call in order to get started. If you're approached with an investment opportunity that seems too good to be true, be cautious and do your research before handing over any money.

Some common red flags to look out for include:

You're recruited by someone you don't know, or the requirement is for you to recruit other people.

You're asked to invest in something you don't understand.

The investment involves high fees or hidden costs.

There is a sense of urgency, or you're told you need to act now in order to get in on the deal.

If you spot any of these warning signs, it's likely that you're dealing with a scammer. Don't let yourself be taken advantage of - remember, it's far more likely to be a scam than a great money making ideas.

Examples of get rich quick scams

Cryptocurrency

NFTs (Non-Fungible Tokens)

Multi-level marketing schemes

The lottery (national or international)

Lottery advice scams

'Prince of Nigeria' type scams

Money locked abroad scams

Stock market scams

Penny stocks

All advance-fee scams

Fake-price scams

Mystery shopper scams

Phony Job Listings

Sell domain names

If you're ever approached about an investment opportunity, make sure to do your research before putting any money down. It's too easy to get into credit card debt, or falling for an phone way to money online.

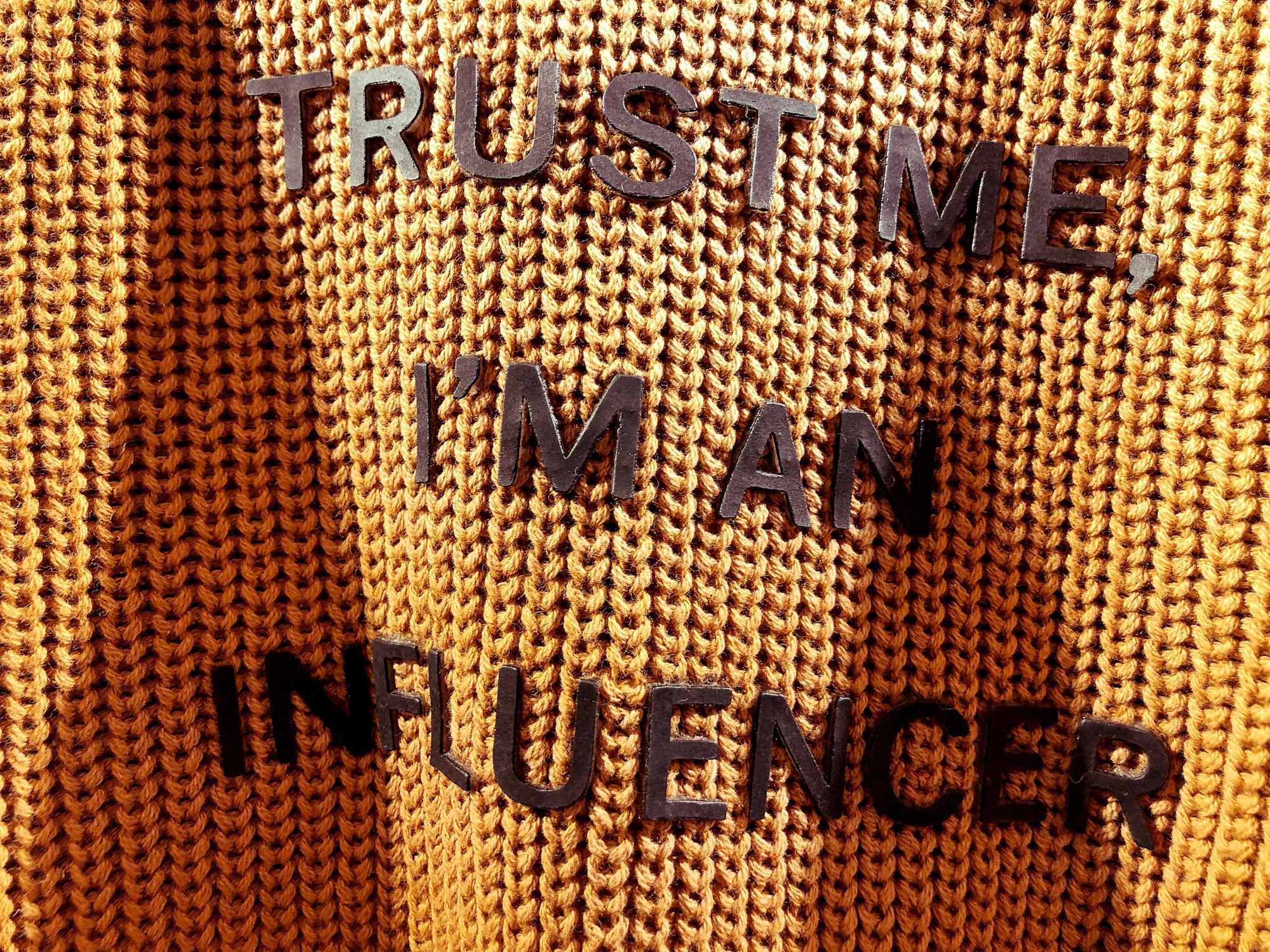

Be VERY wary of advice from online 'influencers'

Have you ever seen an influencer advertise a get-rich-quick scheme and thought to yourself, "That sounds too good to be true"? Well, unfortunately, in most cases, it is. While there are a few legitimate ways to make some extra money without much effort, most "get rich quick" schemes are nothing more than scams.

The people behind these scams know that people are always looking for easy ways to make money, so they create false advertising that promises easy wealth. And because influencers are paid based on how many people they can reach, they have an incentive to promote these schemes to as many people as possible - even if it means duping their followers into losing money.

So, the next time you see an influencer promoting a get-rich-quick scheme, remember that chances are it's too good to be true.

Secrets are always involved

There's no such thing as a get-rich-quick scheme. If someone tells you otherwise, they're probably trying to scam you. Real wealth takes time to build. It requires patience, hard work, and discipline. While there's no guarantee you'll become a millionaire overnight, there are definitely some things you can do to increase your chances of achieving financial success.

One of the most important things is to invest your money wisely. This means putting your money into assets that have the potential to grow in value over time. It also means being patient and not selling too soon. By taking a long-term approach to investing, you give yourself a much better chance of achieving real wealth than a quick few bucks.

So don't believe the hype when it comes to get-rich-quick schemes. Instead, focus on building your own wealth slowly and steadily over time.

How get rich quick scams work

Millions of people around the world are looking for ways to become rich quickly. And there are plenty of scammers who are more than happy to take advantage of those desires.

Get-rich-quick schemes come in many different forms, but they all share a common goal: to convince people to part with their hard-earned money in the hopes of achieving financial goals that are simply unattainable.

One of the most common get-rich-quick scams is the so-called "investment opportunity." These schemes typically involve promising investors extraordinarily high returns on their investment, often with the promise of becoming rich overnight. Of course, there's no such thing as a guaranteed investment, and these opportunities always end up being nothing more than empty promises. In fact, many people have lost their life savings by investing in get-rich-quick schemes.

So how can you avoid falling victim to a get-rich-quick scam? The best defence is always a healthy dose of scepticism.

Be especially careful of any investment that promises guaranteed returns or claims to be risk-free. No investment is ever completely risk-free, and anyone who tells you otherwise is likely trying to scam you.

Always collect more info and research into the company, ideas, and their own personal interest. If you're not sure about an investment, ask a financial advisor or consult somebody who has expertise in the area.

Get-rich-quick schemes are unfortunately all too common. But by being aware of how they work and taking steps to protect yourself, you can avoid becoming just another victim.

Payment is often required upfront

There are many different get rich quick scams out there, but one of the most common is the upfront payment scam. In this type of scam, the victim is promised a large sum of money if they make an upfront payment.

The victim is often told that this is the best investment they will ever make, and that it will help them achieve their financial goals. Unfortunately, the only person who ever gets rich in these scams is the person running the scam.

The victim ends up losing their life savings, and their dreams of becoming rich overnight are dashed. If you are ever asked to make an upfront payment in a get rich quick scheme, say bye bye to your hard-earned money and walk away.

Scammers often advertise "No experience necessary"

Get rich quick schemes have been around for centuries, preying on the hopes and dreams of those who are looking for an easy way to make money. The problem is, there is no such thing as easy money.

If there was, everyone would be rich.

The truth is, these schemes usually involve taking on a lot of debt, or investing money without any experience or knowledge of how to do so properly.

This can often lead to people losing more money than they started with. So, if you're thinking about taking part in one of these get rich quick schemes, beware. You could end up in credit card debt or worse off financially than you were before.

100% success rate? Pfft.

We've all seen the ads: "Make money quickly and easily with our get rich quick scheme!" They promise guaranteed success and often advertise a 100% success rate.

Advertising a 100% success rate is one way that get rich quick scams lure in potential victims. They promise easy money with little effort, often by investing in the stock market or starting your own business.

The reality is that there is no guarantee of making money quickly, and these schemes often end up costing people more than they ever make. Get rich quick scams are often run by experienced con artists who know how to take advantage of people's desires to become wealthy quickly.

'Get rich quick' scams prey on the vulnerable, especially in the current economy

Vulnerable people are often targeted by scammers who promise to help them make rich quickly. These scammers typically ask for personal information or money upfront in exchange for access to their system or services. They may also ask people to complete surveys or watch videos in order to earn extra cash.

While it is possible to make money online, there is no guarantee that people will be able to make a significant amount of money using these methods. Consequently, it is important to be wary of any opportunity that promises easy money. If something sounds too good to be true, it likely is. By being informed and taking precautions, people can protect themselves from becoming victims of these scams.

Beware of Illegal businesses with no credibility.

Get rich quick scams are illegal businesses that promise their victims huge amounts of money in return for a small investment. The victims are told that they will become rich overnight, often by earning millions of dollars through a new income stream. However, the only people who earn any money from these schemes are the scammers themselves. The websites set up to promote these schemes are usually run by anonymous individuals with no credibility or experience in the business world.

Furthermore, the investments required to join these schemes are often entirely non-existent. In conclusion, get rich quick scams are nothing more than a way for scammers to line their own pockets at the expense of unsuspecting victims.

How to avoid quick money making scams?

1. Don't pay for information about making money online. There are a lot of free resources available that can provide you with all the information you need. Anyone who asks for money upfront is likely trying to scam you.

2. Avoid get-rich-quick schemes. These are usually too good to be true and only end up costing you money in the long run.

3. Be wary of opportunities that require you to invest money upfront. Many legitimate businesses require an investment, but if the opportunity seems too good to be true, it probably is.

4. Don't give out your personal information to someone you don't know. Scammers will often try to get your bank account or credit card information by promising easy money. Don't fall for it - only give out your personal information to trusted sources.

5. Be careful of work-from-home job offers that seem too good to be true. Many scammers will pose as legitimate businesses in order to get your personal information or lure you into paying for a starter kit or other upfront fee. Do your research before taking any job offer, and never pay anything until you're sure it's a legitimate opportunity.

Protect your personal information at all times

It's no secret that fraud and scam artists are becoming increasingly sophisticated in their methods of targeting victims. One of the most common ways they're able to do this is by obtaining personal information such as names, addresses, birthdates, Social Security numbers, and so on. Once they have this information, they can use it to open new accounts in your name, apply for credit cards, and even take out loans. In some cases, they may even use your information to commit identity theft. That's why it's so important to protect your personal information at all times. Be careful about what you share online and with whom you share it. Don't provide more information than absolutely necessary when providing it to businesses or other organizations. Be sure to keep your computer security up-to-date, and never click on links or attachments from unknown sources. By taking these precautions, you can help protect yourself from becoming a victim of fraud or scam.

Conclusion

Unfortunately, there are always people looking to take advantage of others, and the internet has made it easier than ever for fraudsters to reach a wide audience. Get-rich-quick schemes are a prime example of this, promising easy money with little effort required. However, these schemes are nothing more than scams, designed to steal your hard-earned cash. So how can you protect yourself? The first step is to be vigilant. Be wary of any offer that seems too good to be true, and do your research before hand. Check for reviews and speak to others who have used the service. If something doesn't feel right, trust your gut and walk away. Remember, if an offer seems too good to be true, it probably is.