How To Avoid Telephone Banking Scams?

Telephone banking scams involve fraudsters pretending to be from a bank or other trusted organization, calling victims and tricking them into giving out sensitive information such as account numbers or passwords. They may also pressure victims into transferring money to another account - usually the scammer's one.

These scams can happen to anyone, but older adults are often targeted due to their tendency to be more trusting and less aware of current scam tactics.

It is important for everyone to stay vigilant when receiving calls from unknown numbers, especially those claiming to be from financial institutions.

We therefore suggest the most common tactics of scammers and how to avoid them.

Why telephone banking fraud is so dangerous?

In the report: "UK Finance Annual Fraud Report" we read: "A total of £41.6 million of attempted telephone banking fraud was stopped by bank security systems during 2021. This is equivalent to 72.9p in every £1 of fraud attempted being prevented. In addition, 12 per cent (£1.9 million) of the losses across the telephone banking channel were recovered after the incident."

Source: "UK Finance Annual Fraud Report"

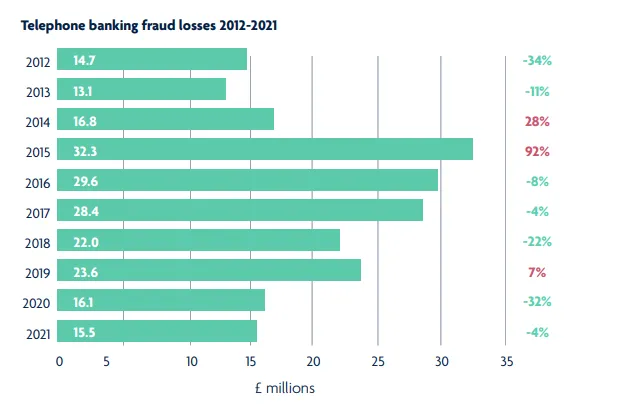

How much is lost to telephone fraud?

According to report by UK Finance the value of telephone banking fraud losses was £15.5 mln and was 4% lower than in 2020. Let us hope that this downward trend continues for the next few years, especially as the same report states that annual case volumes for telephone banking fraud in 2021 was 4,623 and was 38% lower than the previous year.

The most common telephone banking scams

One scam to be aware of is when a fraudster calls posing as a bank representative and claims there has been suspicious activity on your account. They may ask for personal information, such as your credit card number or online banking password, in order to "verify" your identity. Do not give out this information over the phone- instead, hang up and call your bank directly using the number listed on their official website or the back of your card.

They may also call to offer you a better credit offer or savings account. These types of offers are usually time-limited in order to create a false sense of urgency. Under time pressure, you are prone to give away important information.

Another common telephone banking scam involves receiving a call from someone claiming to be from tech support for your bank's mobile app or online banking platform. The scammer may try to gain access to your computer by asking you to download software or giving them remote access. Again, do not provide this information and contact your bank directly to verify the legitimacy of the call.

Another common tactic is called "smishing," where the fraudster sends a text message claiming there is an issue with your bank account and asks you to call a number or visit a website that will steal your personal information.

It's important to remember that legitimate banks and organizations will never ask for confidential information over the phone or through text messages. If you receive suspicious calls or texts, do not respond and contact your bank immediately. Protect yourself by staying vigilant and never giving out personal information over the phone.

Even if you receive a call from a familiar number from your bank or other institution, be aware that fraudsters can easily impersonate such numbers and clone, for example, your bank's telephone number. Always be suspicious.

Additionally, be sure to regularly monitor your bank statements for any unusual activity. If you notice any unauthorized transactions, report them immediately to your bank. By being aware of these scams and taking steps to protect yourself, you can avoid falling victim to telephone banking fraud.

Is telephone banking safe?

The short answer is yes, telephone banking can be safe as long as you take the necessary precautions. While some may argue that using a phone to conduct banking transactions leaves your information vulnerable to potential hackers, the truth is that telephone banking can actually be just as secure as online banking. Most banks use advanced security measures such as call encryption, FaceID and caller verification processes to protect their customers' information.

Additionally, it's important to remember that no method of banking is completely risk-free - even something as seemingly secure as ATMs can be subject to fraud or theft.

Where to report scam calls?

If you've been targeted by telephone scams, or worse yet have fallen victim to one you need to report it as soon as possible.

First, contact your bank or card issuer immediately. Even if you think it's a fraud, call them and let them know so they can warn other customers and take appropriate action. If you're sure it's a scam or have already given away personal information like credit card numbers, tell the authorities right away so your money is protected and the scammers are caught.

Second, file a report with Action Fraud at 0300 123 2040.

What to do to avoid being scammed?

It's important to always be cautious when receiving calls related to your bank account and never give out personal details or access to your devices. If you suspect a scam, report it to your bank immediately. And remember, your bank will never ask for sensitive information over the phone. Trust your instincts and stay alert to protect yourself from fraudsters.

Another tip is to never click on links or download attachments from unknown senders in emails claiming to be from your bank- these could contain viruses that may compromise the security of your accounts and personal information.

Always log into online banking directly through the official website or mobile app instead of clicking on links in emails. Stay safe online by keeping up-to-date on the latest scams and being vigilant about protecting your personal information.

Be cautious of unsolicited requests for your personal or financial information as they could be a scam. To be on the safe side, only communicate with the company using an email or phone number you know to be legitimate.

What has been done to reduce bank fraud?

- VoiceID biometrics systems, such as the one announced by HSBC in May 2021, have been shown to reduce telephone banking fraud attempts by up to 50%. In 2020 alone, this saved £249m in attempted fraud.

- Some other anti-fraudulent methods are confirmation of payee measures, which entitle the checker to compare the mentioned name with the account owner's before any money is sent.

- In 2019, multiple large banks joined forces to form the APP Voluntary Code. This code prevented customers from unknowingly sending money to a fraudster and refunded those who had been tricked in the past.

Telephone banking fraud is a growing issue. Fraudsters are constantly inventing new techniques that not only institutions such as banks, but also telephone service providers have to keep up with.

Only a fraudster could ask you to transfer money to another account

In general, it's always best to err on the side of caution when it comes to any communication related to your bank account.

If something seems suspicious or too good to be true, it likely is. Pay attention to what you are told, e.g. only a fraudster could ask you to transfer money to another account. Can you imagine such a question coming from the mouth of a bank employee?

Trust your instincts and never hesitate to contact your bank directly for verification before giving out any personal information or access. Protecting yourself from fraudsters is worth taking extra precautions. Stay safe!